Users can trade cryptocurrencies in a non-custodial setting on a decentralized exchange (DEX), which is a peer-to-peer marketplace that eliminates the need for a middleman to handle the transfer and custody of funds. Due to its brilliant design, Uniswap’s Decentralized Exchange (DEX) is a significant advancement in the cryptocurrency sector.

Table of Contents

How Do Decentralized Exchanges Work?

The process of setting up an exchange account and purchasing bitcoin with dollars is probably familiar to everyone who purchases cryptocurrencies, but many people have never exchanged one cryptocurrency for another via a decentralized exchange, or “DEX.” DEXes are incredibly beneficial for the industry as a whole, but they also pose problems for consumer protection and regulation, and scammers and hackers routinely utilize them as tools for cryptocurrency crime.

Customers typically open an account with a centralized exchange like Coinbase or Binance in order to purchase cryptocurrencies with fiat money (i.e., virtual dollars). All centralized exchanges demand customers deposit money or cryptocurrency before they can purchase or sell anything, which can be disastrous if the exchange is compromised. As a result of the frequent exchange hacks that occurred in the early days of blockchain, seasoned crypto users increasingly fear centralized exchanges and store their crypto on hardware wallets, which offer protection from hackers, until they are ready to sell. For several years, this would be the situation for many crypto owners, until the Uniswap protocol sparked a revolution.

History of DEX

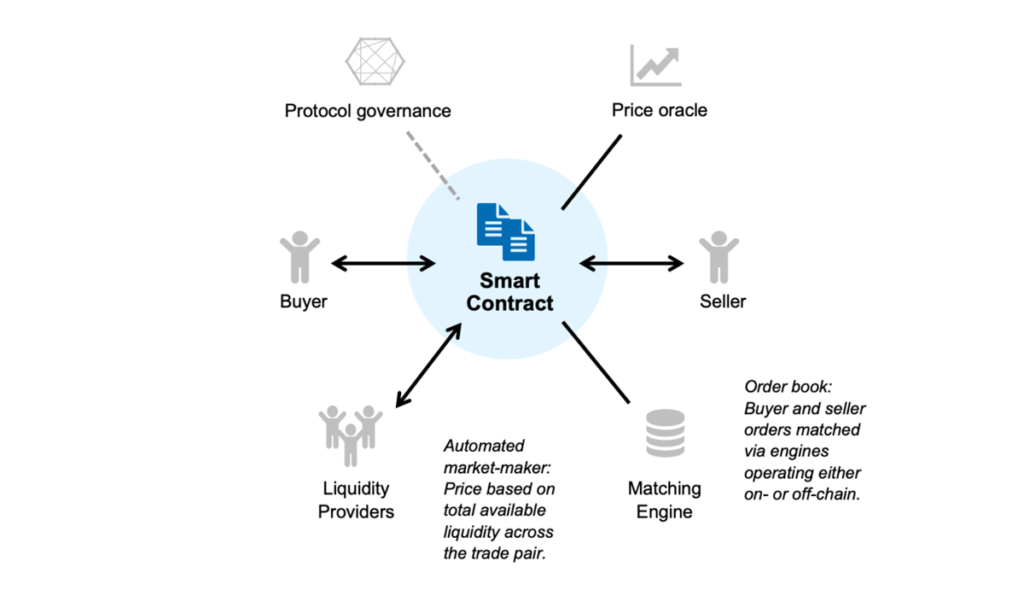

The first DEX (also known as an “Automated Market Maker” or AMM) to experience widespread adoption by cryptocurrency users was Uniswap. A DEX is a cryptocurrency trading program that allows users to buy and sell cryptocurrency straight from their wallets by exchanging tokens using blockchain smart contracts. According to Coinbase, DEXes let users list and sell cryptocurrencies directly from their accounts, which has been a miracle for fledgling cryptocurrency ventures. DEXes are created in accordance with the ERC-20 fungible token standard, making them work with all stablecoins (cryptocurrencies pegged to the dollar) but not NFTs. Today, thousands of cryptocurrencies are traded on DEXes, thus those searching for a “1000x jewel” need to be familiar with them.

Features & Advantages of DEX

DEXes, despite having straightforward user interfaces, are difficult for beginners to use since they only deal in cryptocurrencies, need the user to connect a wallet and pay their own gas fees, and require the user to be certain they are exchanging for the right token.

Ethereum-compatible Trading is facilitated by “liquidity pools” rather than traditional order books on DEXes. Liquidity pools were developed to address the issues that make order books nearly difficult to employ on Ethereum and related blockchains. In a liquidity pool, which is a type of smart contract, “liquidity providers” give the tokens (“liquidity”) that other users trade with in exchange for a portion of the transaction costs. Liquidity provision is quite risky, as CoinTelegraph outlines in great depth, and should only be pursued by experienced users who can reduce the risk.

When centralized exchanges fall offline during periods of extreme volatility, DEXes can continue to function. Additionally, because DEXes can be used by other smart contracts, they can enable Web3 firms to accept any token as a payment method.

Disadvantages of DEX

DEXes do, however, have drawbacks. Large trades might result in “slippage,” which negatively affects a token’s price and lowers the total amount received, making it challenging to offer consumers limited order capabilities. DEXes are only able to trade tokens created on the same blockchain, and cannot trade tokens across different blockchains. DEXes are also a regulatory nightmare because they are frequently used by hackers to exchange stolen stablecoins before passing them through a Tornado Cash-like cryptocurrency mixer business. Scammers can empty their liquidity pool once enough victims have exchanged legitimate coins for the scam coin, bringing the price to zero, by listing their crypto scam-coins on DEXes.

Conclusion

DEXes are a crucial component of the infrastructure for decentralized finance since they enable users and smart contracts to exchange any two cryptocurrencies on the same chain in a single transaction. Every smart contract blockchain, including PancakeSwap on Binance Chain, Quickswap on Polygon, and Raydium on Solana, contains at least one since they are so crucial. Although occasionally troublesome, DEXes is a powerful blockchain innovation that could influence the future financial system and will be a crucial part of the Web3 internet era powered by blockchain, though it is unclear how regulators will deal with their problems.